上次课留下的思考题

题目思路

- 读入数据

- 进行数据可视化

- 计算日收益率

- 简单比较高vs低收市盈率组合是否存在显著差异

首先我们安装tidyquant包,这个包是R做量化投资、金融分析的核心包,我们将大量使用这个包进行分析

这个包的安装方法和其他包一样都是install.packages(“tidyquant”),如果需要安装开发版的同学可以去github上自行学习,相信你们都会用github了,下载开发版肯定不是问题

# 读入数据,注意目录位置

getwd() #使用这个命令可以知道当前目录的位置,从而定位我们要读入文件的位置## [1] "D:/github/giteeweb/content/post"# 使用pacman这个包的好处是帮可以帮我们载入指定包,如果该指定包没有安装,则进行安装

pacman::p_load(tidyverse, tidyquant,readxl,DT)

pe_data <- read_excel("data/pe_data.xls",

skip = 2)

colnames(pe_data)<-c("date","pehigh","pelow")

pe_data %>% datatable()str(pe_data)## Classes 'tbl_df', 'tbl' and 'data.frame': 2454 obs. of 3 variables:

## $ date : POSIXct, format: "2010-03-01" "2010-03-02" ...

## $ pehigh: num 1226 1223 1239 1198 1201 ...

## $ pelow : num 5053 5028 5060 4932 4936 ...我们使用str()函数观察一下数据结构,读入的数据是3列(3个特征),2454个观测值(obs),第一个特征是时间,第二个是pehigh组指数,第二个是pelow组指数

# 我们使用tidyvers分析流程进行数据转换

# 我们先将第一个日期时间的格式再次转换一下

pe_data <- pe_data %>% mutate(date = as.Date(date,format="%Y-%m-%d"))目前这个数据结构是所谓的宽数据,接下来把数据转换为所谓的长数据(long),利用长数据进行作图,我们使用

pe_data_long <- pe_data %>%

pivot_longer(-date,names_to = "pe_group",values_to = "values")

#使用ggplot进行画图,用颜色区分市盈率高低组

p <- ggplot(pe_data_long,aes(x=date,y=values,color = as.factor(pe_group)))+

geom_line(size=1.1,alpha=0.6)+ ggtitle("A股市盈率高低组指数2010-2020年") + xlab("时间") + ylab("指数")+

theme_tq()

# 我们使用了一下plotly包,可以生成交互式的图,这里使用包名加两个冒号调用包中的函数

fig <- plotly::ggplotly(p)

fig接下来计算收益率

日收益率计算公式:

\[r=\frac{value_t-value_{t-1}}{value_{t-1}}\]

### 计算日收益率

我们直接利用包计算日收益率,先参看包能给我们做什么,我们使用tidyquant包下面的tq_transmute集成函数进行,主要使用其中的“dailyReturn” , “monthlyReturn”, “yearlyReturn” 进行展示,tq_tansmute函数具体帮助地址:这里

tq_transmute_fun_options()## $zoo

## [1] "rollapply" "rollapplyr" "rollmax"

## [4] "rollmax.default" "rollmaxr" "rollmean"

## [7] "rollmean.default" "rollmeanr" "rollmedian"

## [10] "rollmedian.default" "rollmedianr" "rollsum"

## [13] "rollsum.default" "rollsumr"

##

## $xts

## [1] "apply.daily" "apply.monthly" "apply.quarterly" "apply.weekly"

## [5] "apply.yearly" "diff.xts" "lag.xts" "period.apply"

## [9] "period.max" "period.min" "period.prod" "period.sum"

## [13] "periodicity" "to.daily" "to.hourly" "to.minutes"

## [17] "to.minutes10" "to.minutes15" "to.minutes3" "to.minutes30"

## [21] "to.minutes5" "to.monthly" "to.period" "to.quarterly"

## [25] "to.weekly" "to.yearly" "to_period"

##

## $quantmod

## [1] "allReturns" "annualReturn" "ClCl" "dailyReturn"

## [5] "Delt" "HiCl" "Lag" "LoCl"

## [9] "LoHi" "monthlyReturn" "Next" "OpCl"

## [13] "OpHi" "OpLo" "OpOp" "periodReturn"

## [17] "quarterlyReturn" "seriesAccel" "seriesDecel" "seriesDecr"

## [21] "seriesHi" "seriesIncr" "seriesLo" "weeklyReturn"

## [25] "yearlyReturn"

##

## $TTR

## [1] "adjRatios" "ADX" "ALMA"

## [4] "aroon" "ATR" "BBands"

## [7] "CCI" "chaikinAD" "chaikinVolatility"

## [10] "CLV" "CMF" "CMO"

## [13] "DEMA" "DonchianChannel" "DPO"

## [16] "DVI" "EMA" "EMV"

## [19] "EVWMA" "GMMA" "growth"

## [22] "HMA" "KST" "lags"

## [25] "MACD" "MFI" "momentum"

## [28] "OBV" "PBands" "ROC"

## [31] "rollSFM" "RSI" "runCor"

## [34] "runCov" "runMAD" "runMax"

## [37] "runMean" "runMedian" "runMin"

## [40] "runPercentRank" "runSD" "runSum"

## [43] "runVar" "SAR" "SMA"

## [46] "SMI" "SNR" "stoch"

## [49] "TDI" "TRIX" "ultimateOscillator"

## [52] "VHF" "VMA" "volatility"

## [55] "VWAP" "VWMA" "wilderSum"

## [58] "williamsAD" "WMA" "WPR"

## [61] "ZigZag" "ZLEMA"

##

## $PerformanceAnalytics

## [1] "Return.annualized" "Return.annualized.excess"

## [3] "Return.clean" "Return.cumulative"

## [5] "Return.excess" "Return.Geltner"

## [7] "zerofill"pe_data_return <- pe_data_long %>% drop_na() %>%

group_by(pe_group) %>%

tq_transmute(select = values,

mutate_fun = dailyReturn)

str(pe_data_return)## Classes 'grouped_df', 'tbl_df', 'tbl' and 'data.frame': 4904 obs. of 3 variables:

## $ pe_group : chr "pehigh" "pehigh" "pehigh" "pehigh" ...

## $ date : Date, format: "2010-03-01" "2010-03-02" ...

## $ daily.returns: num 0 -0.00167 0.01301 -0.03375 0.0032 ...

## - attr(*, "groups")=Classes 'tbl_df', 'tbl' and 'data.frame': 2 obs. of 2 variables:

## ..$ pe_group: chr "pehigh" "pelow"

## ..$ .rows :List of 2

## .. ..$ : int 1 2 3 4 5 6 7 8 9 10 ...

## .. ..$ : int 2453 2454 2455 2456 2457 2458 2459 2460 2461 2462 ...

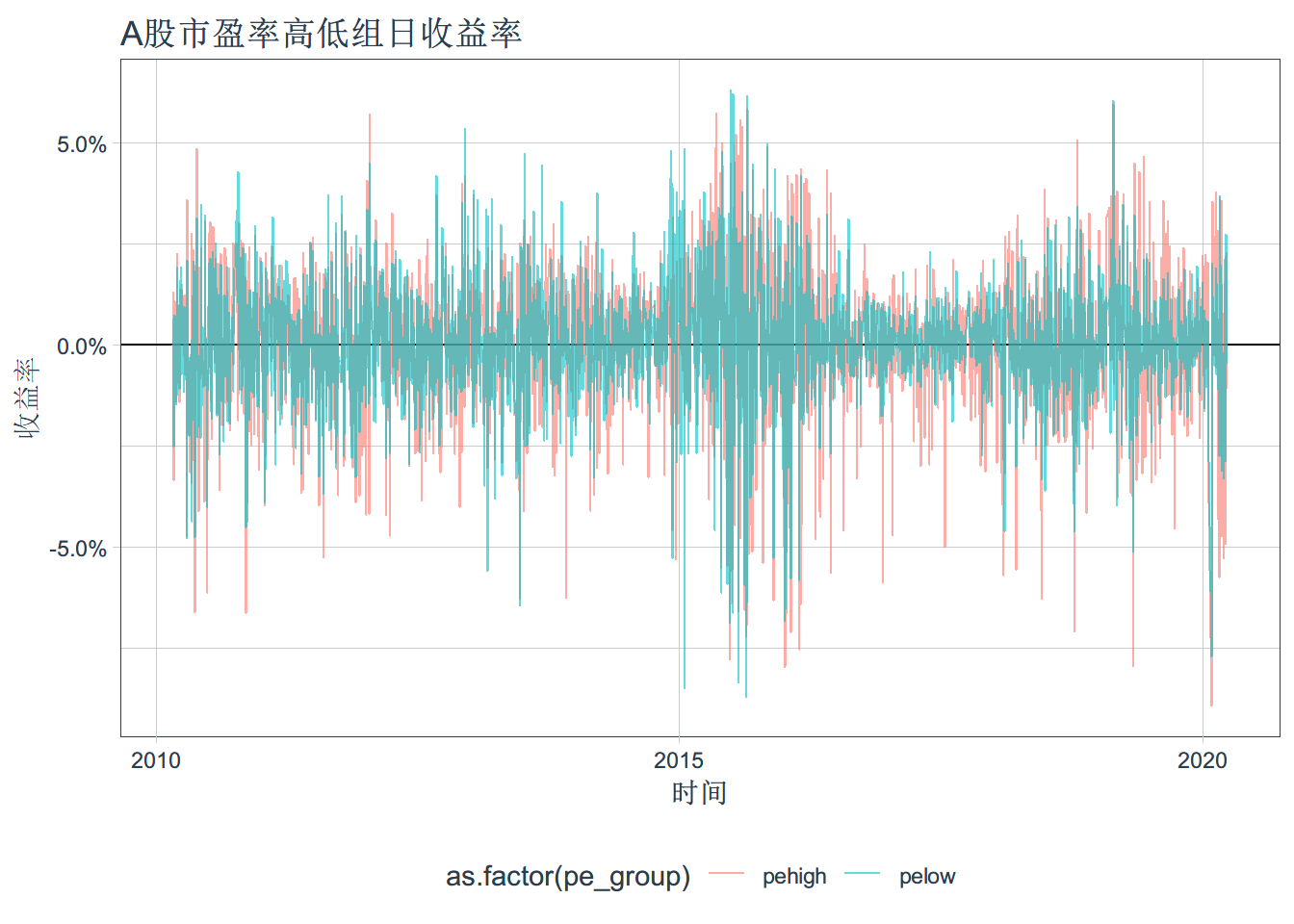

## ..- attr(*, ".drop")= logi FALSEggplot(pe_data_return,aes(x=date, y=daily.returns, color = as.factor(pe_group)))+

scale_y_continuous(labels = scales::percent)+geom_hline(yintercept = 0)+

geom_line(alpha=0.6)+ ggtitle("A股市盈率高低组日收益率") + xlab("时间") + ylab("收益率")+

theme_tq()计算季度收益率

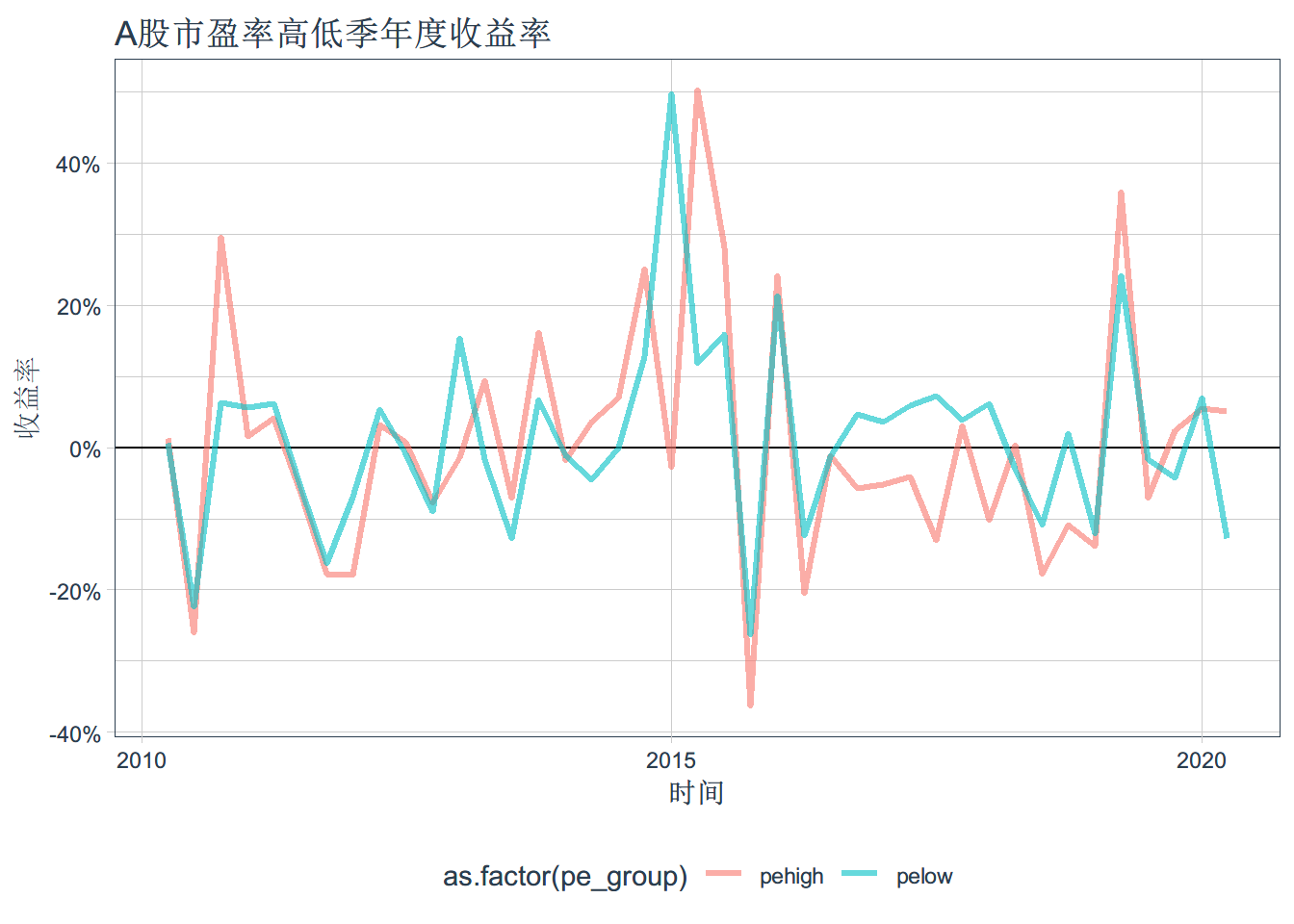

我们直接利用tidyquant包计算季度收益率

pe_data_return_q <- pe_data_long %>% drop_na() %>%

group_by(pe_group) %>%

tq_transmute(select = values,

mutate_fun = quarterlyReturn)

ggplot(pe_data_return_q,aes(x=date, y=quarterly.returns, color = as.factor(pe_group)))+

scale_y_continuous(labels = scales::percent)+geom_hline(yintercept = 0)+

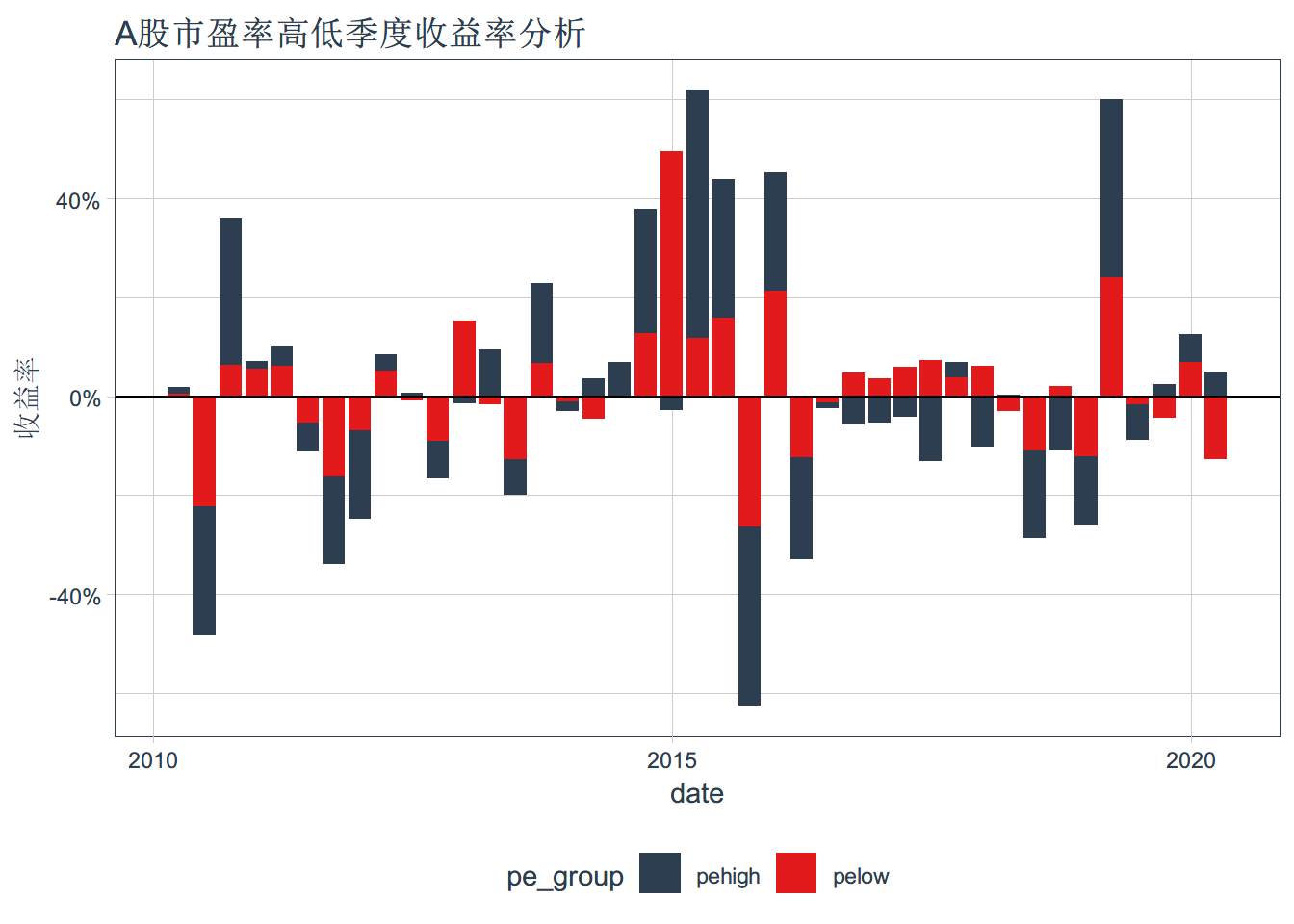

geom_line(size= 1.1,alpha=0.6)+ ggtitle("A股市盈率高低季年度收益率") + xlab("时间") + ylab("收益率")+ theme_tq()ggplot(pe_data_return_q,aes(x=date,y=quarterly.returns,fill=pe_group))+ geom_col()+geom_hline(yintercept = 0)+

scale_y_continuous(labels = scales::percent) +theme_tq()+ scale_fill_tq()+ggtitle("A股市盈率高低季度收益率分析") + ylab("收益率")计算年度收益

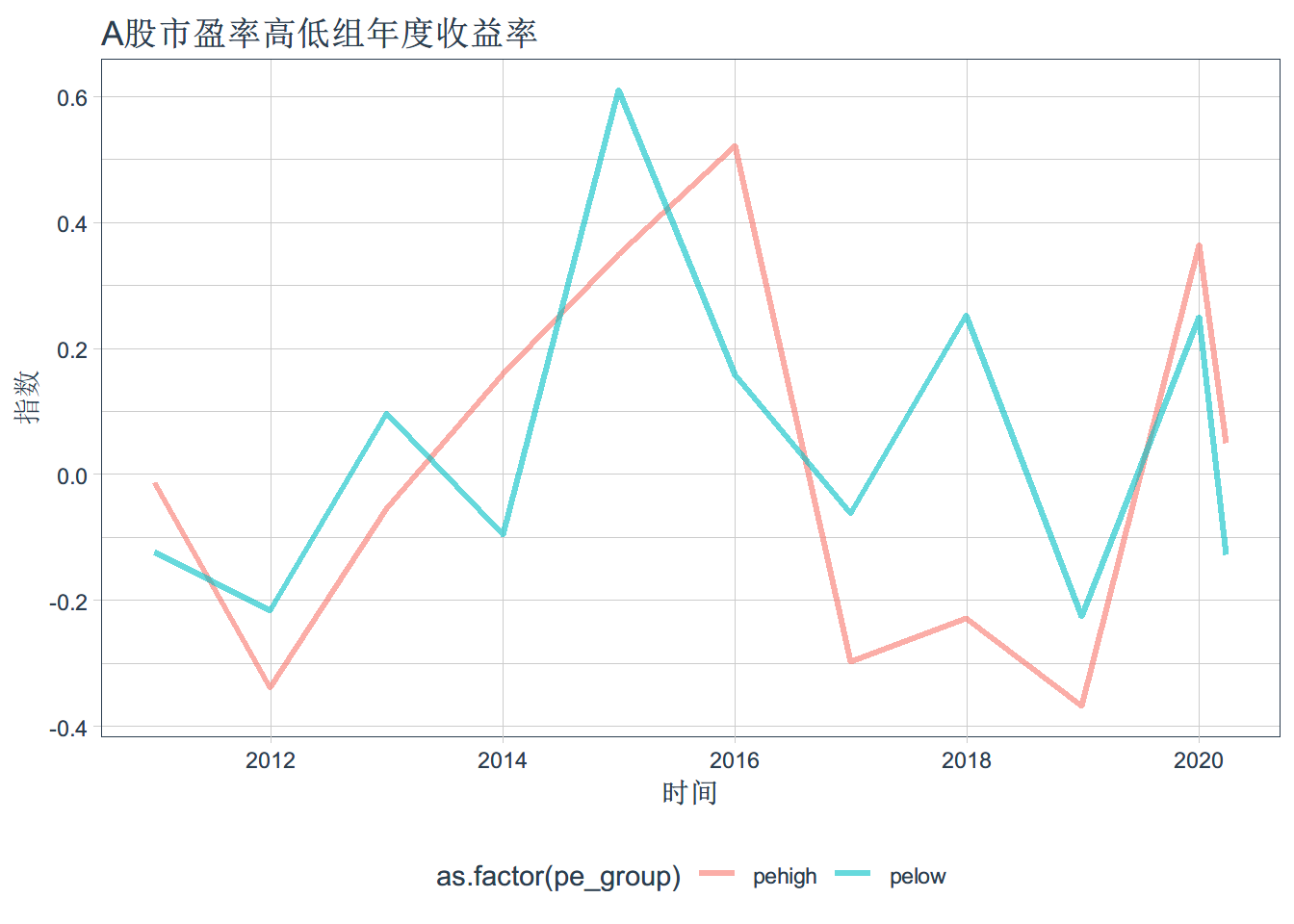

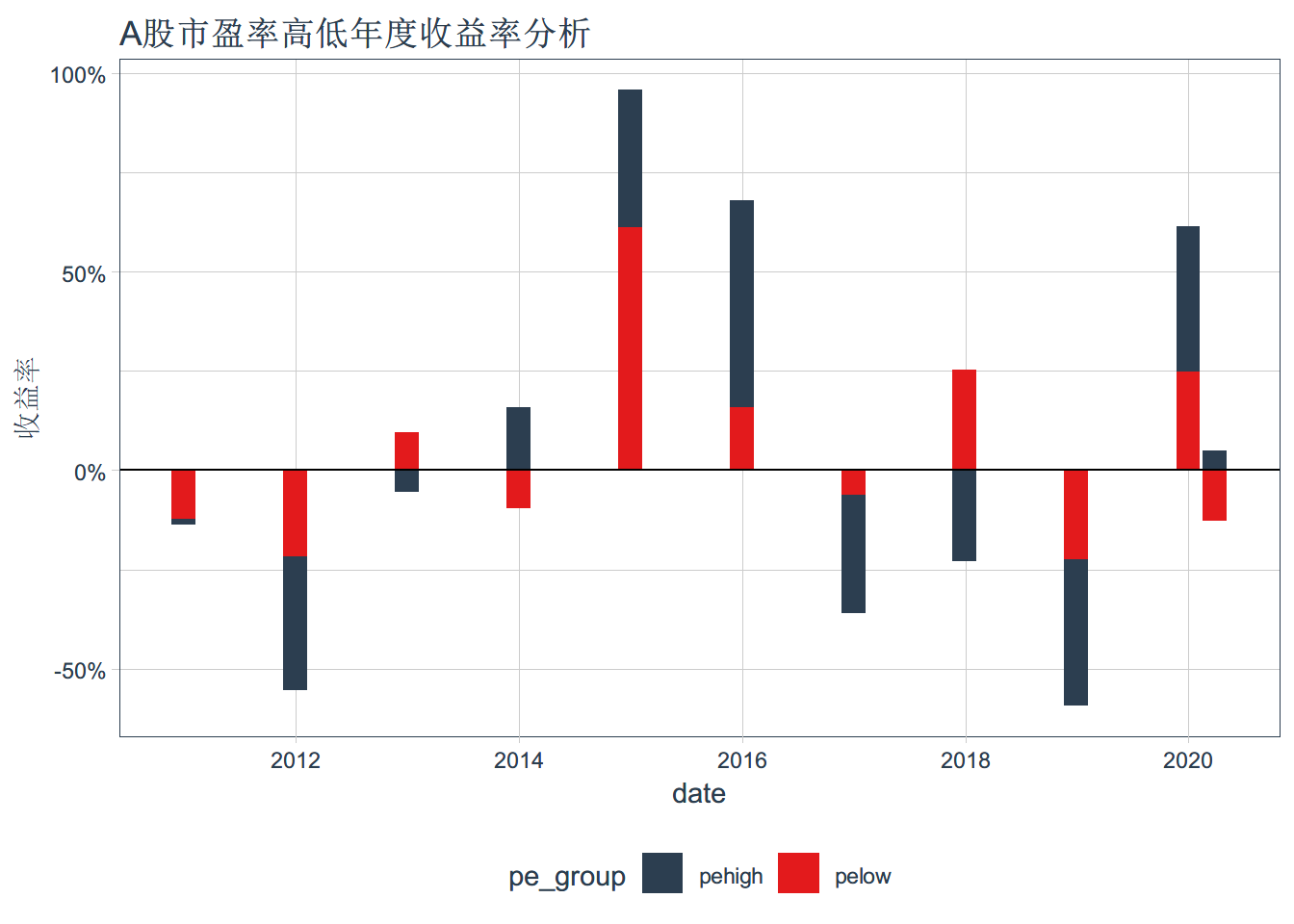

pe_data_return_y <- pe_data_long %>% drop_na() %>%

group_by(pe_group) %>%

tq_transmute(select = values,

mutate_fun = yearlyReturn)

ggplot(pe_data_return_y,aes(x=date, y=yearly.returns, color = as.factor(pe_group)))+

geom_line(size= 1.1,alpha=0.6)+ ggtitle("A股市盈率高低组年度收益率") + xlab("时间") + ylab("指数")+ theme_tq()ggplot(pe_data_return_y,aes(x=date,y=yearly.returns,fill=pe_group))+ geom_col()+geom_hline(yintercept = 0)+

scale_y_continuous(labels = scales::percent) +theme_tq()+ scale_fill_tq()+

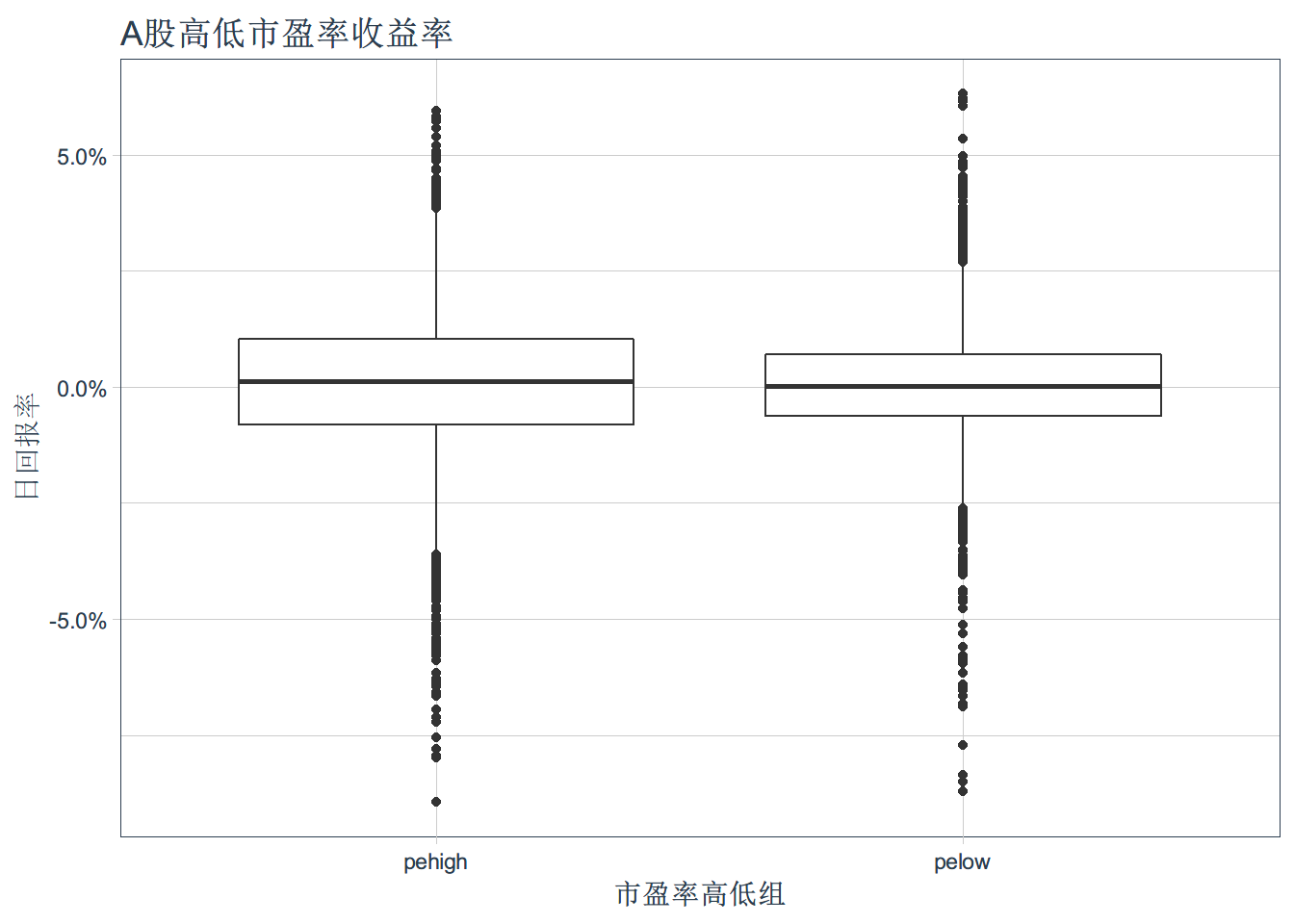

ggtitle("A股市盈率高低年度收益率分析") + ylab("收益率")组间差异判断

接下来,我们分析一下是否高低市盈率组投资组合是存在显著差异,我们这里就只比高低组PE较全部样本

ggplot(pe_data_return,aes(x=pe_group,y=daily.returns))+

scale_y_continuous(labels = scales::percent) +

geom_boxplot() + theme_tq() +

ggtitle("A股高低市盈率收益率") + xlab("市盈率高低组") + ylab("日回报率")t.test(daily.returns ~ pe_group, data = pe_data_return, paired = TRUE)##

## Paired t-test

##

## data: daily.returns by pe_group

## t = -0.65314, df = 2451, p-value = 0.5137

## alternative hypothesis: true difference in means is not equal to 0

## 95 percent confidence interval:

## -0.0006873786 0.0003438866

## sample estimates:

## mean of the differences

## -0.000171746